Top 15 Best Insurance Companies in the Philippines Must Have 2023

Table of Content

Health insurance companies typically cover the majority of the basic costs of health care, such as lab tests and annual physicals. Some employers may also provide additional benefits such as maternity and dental care that you pay for on your own. Because of the COVID-19 pandemic, some insurance companies have updated their policies to reflect the situation. Longer-term insurance policies typically have lower premiums than short-term policies. You can also choose to shop around for health insurance, depending on your plan category.

An HO-7 policy generally only covers a mobile home when it’s stationary. That’s why it’s important to request quotes for the same levels of coverage—with all applicable discounts factored in—when you’re shopping for homeowners insurance. The amount you have for additional living expenses coverage is typically set at a percentage of your dwelling coverage amount, but you can buy more if you don’t think it’s enough. Auto-Owners Insurance can be a smart choice for its very good prices, low complaint level and option for guaranteed replacement cost coverage. Dog lovers will likely be turned off by banned breed lists or limited liability coverage for the dog.

Pacific Cross Health Care

You can also check out review sites to determine if doing business with them is a good idea. Apart from that, the age of your house can increase the cost of the insurance policy. An old home or a house that’s not well-maintained can fetch a high premium price. Manulife Philippines has partnered with China Bank to launch Manulife China Bank Life Assurance Corporation, a financial platform offering outstanding insurance products to individuals and groups. It’s easy to open an insurance policy with AXA because its financial advisors and executives are in Metrobank and PSBank branches all over the Philippines. Contact home insurance providers to get a quote for your home insurance.

Starting a new family or planning the future for your family can be daunting. But as you ponder on it, you will realize that you have to make important steps to keep your family secure in the long run with the right investment that you have to make. Diseases often come without prior warnings and treatments can be long drawn and can take a major toll on the financial health of the person.

Property Insurance

Clients have the privilege to avail Sun Life’s insurance and investment products. You can link your insurance with Sun Life’s famous bonds, equity, index, and global growth funds. Filipinos can avail the incredible investment funds of Allianz at any PNB branch nationwide. Having a PNB mobile app is also beneficial for paying our premiums at any time. Allianz is one of the biggest financial firms in Europe and the world, while PNB is among the top banks in the Philippines.

Hence, at a reasonable cost, your property is well protected. Established in 1910, the company has over a century-worth of history engaging in the insurance industry in the country. It was also considered at that time as the first Filipino life insurance company.

Q: What is extended coverage?

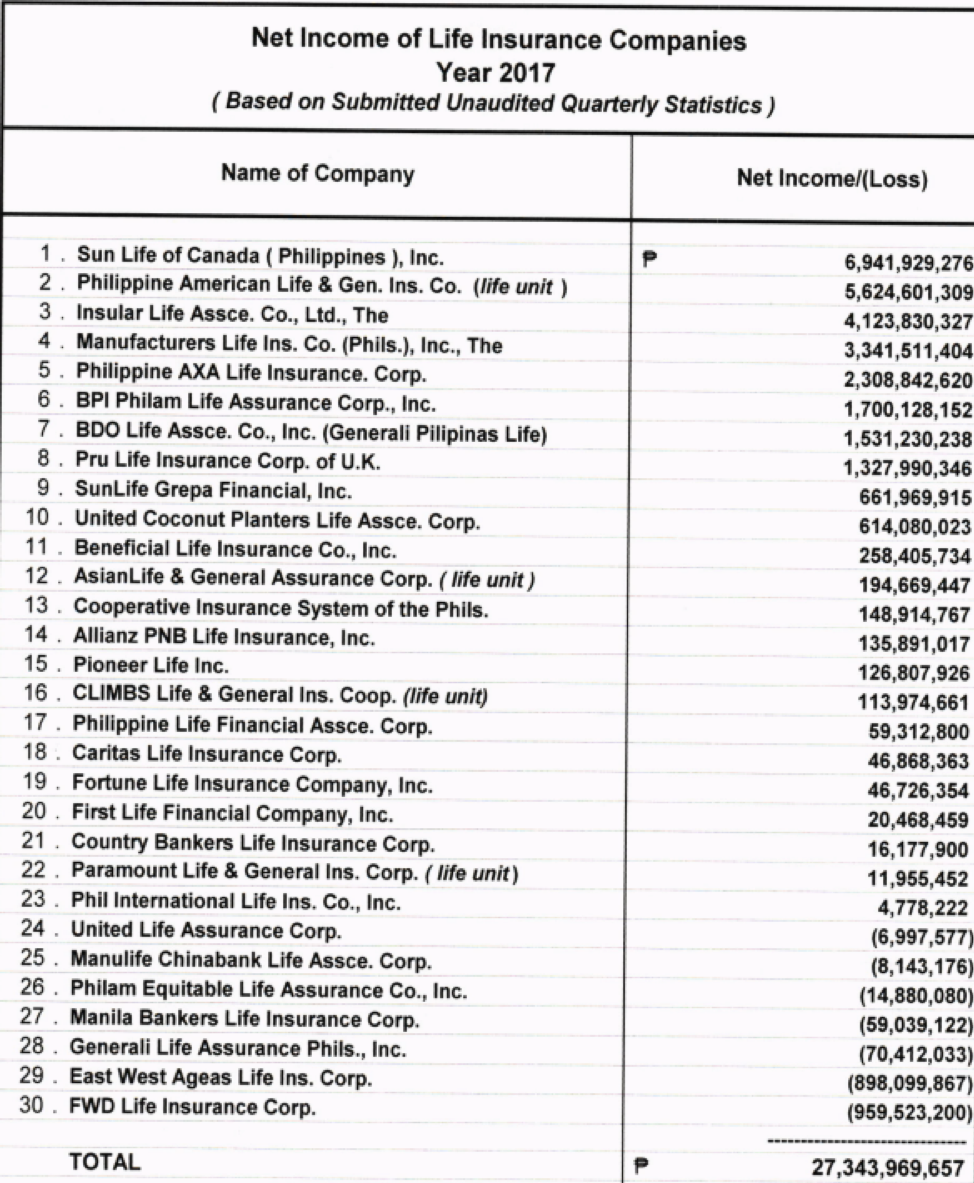

So refrain from getting an advisor you are intimidated to ask. It made considerable advances in premium income by advancing three places, four in NBAPE, and seven in net worth, while there are no changes in its net income and total assets. Sun Lifeis the number one insurer of 2022 based on the latest performance released by the Insurance Commission last April 2022. Thus, It is the 11th consecutive time that Sun Life managed to top the premium income category both in traditional andvariable plans. First, cover the medical cost by selling your properties, using your savings intended for other things, such as the education fund for your kids, building a house, starting a business, etc.

They also have a list of doctors, specialists, and experts that are signed up with them. The Philippines is a popular destination for overseas travellers. The countrys healthcare is considered good by international standards, and government reforms in the past 2 decades are pushing the country closer to universal healthcare. Foreigners qualify for this coverage, and this might be a great reason to consider the Philippines for long-term visit or a permanent relocation. However, even individuals who are unemployed, self-employed or voluntary members can easily get a health card as they wish.

Parol-Making in the Philippines: How and Where Did It Start?

It is critical that your company has business insurance in the event of natural disasters, data breaches, customer injuries, and other similar business crises. You should consider different types of business insurance for each company, depending on its size. The use of data breach and cyber liability insurance is increasing among businesses. It could also cover things like identity protection solutions, public relations damage control, legal fees, and other expenses. Companies of all sizes may also consider Key Man Insurance, which protects a company from potential losses caused by the death of a key person. In the country, a number of trustworthy financial institutions provide a wide range of business insurance products and services to small and midsized enterprises, startups, and large corporations.

A VUL plan is perfect if you want income protection with a wealth accumulation plan. It lets you grow your money while giving you financial security and peace of mind. Then click the link below to request a quotation and financial consultation.

If you ask them why they don’t have fire insurance policy, they commonly answer that it is just an expense and they certainly don’t need it. They believe that fire insurance is expensive and unnecessary. But they are wrong because fire insurance is not that expensive contrary to what many people believe. The Philippines is known as a natural passage for most tropical storms in the world and its location being along the Ring of Fire makes it prone to natural disasters. The country has seen many property damages and homes destroyed thanks to storms, typhoons, and other calamities. Irrespective of a home’s location, size, and security features, no property is invulnerable in these damaging events.

Some of the products and services offered by BPI Home Insurance Philippines include home insurance, fire insurance, contents insurance, and personal liability insurance. Clients will also enjoy additional benefits, such as assistance services, allowance, and personal accident coverage. This type of insurance provides financial protection against home loss and damage. On top of that, it offers liability coverage against accidents that occurred both on the residential property and inside the house.

However, it is not enough to cover major medical health concerns such as stroke, cancer, heart attack, etc. Providing solutions to international and local clients since 1999, Generali Life Assurance Philippines, Inc. has a solid track record, particularly in group life policies. Manulife Chinabank Life Assurance Corporation is a joint venture between Manulife Philippines and China Banking Corporation.

Comments

Post a Comment